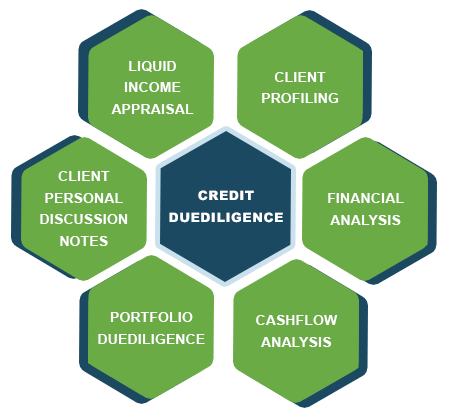

Credit Due-diligence

Credit Risk Underwriting is amongst the most critical area in Banking business. We at Patel Mehta & Associates are having expertise in Credit Due-diligence assignments. Area of our services includes:

Client Profiling

Client Profiling for lenders after meeting customers personally by our professional staff, understanding business model, modus-operandi, cash-flow projections and detailed back-ground checks.

Credit Note Reporting

Providing lenders detailed credit note covering description of client’s place of profit set-up, nature of business, business model, working capital cycles, actual cash-flows and highlighting strengths-weakness & state of affairs of the client in the proposal.

Portfolio Due-diligence

We undertake due diligence for various high value loan transactions, Corporate Loans and delinquent accounts. With our knowledge of credit profiling, financial analysis, our exposure to industry, local market knowledge coupled with our information base of various loan segments, we are able to provide strategic information to financers, helping them to take an objective decision while extending/reviewing loans or credit exposure or taking appropriate decision on legal course of action on delinquent customers.